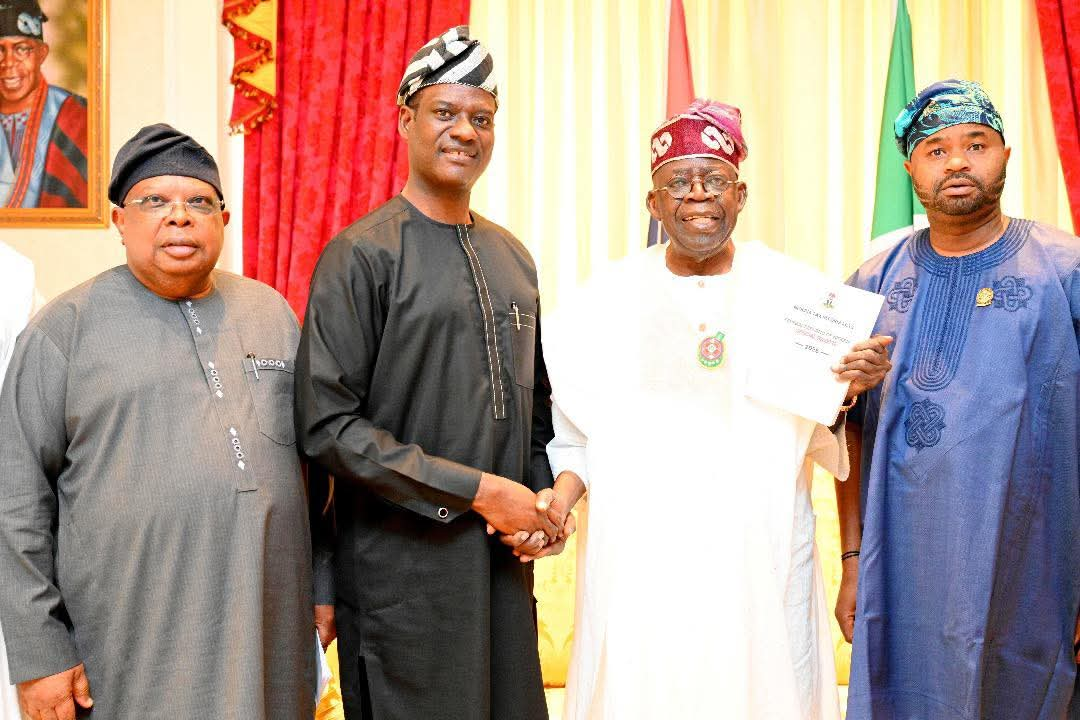

President Bola Ahmed Tinubu has reaffirmed the Federal Government’s resolve to proceed with the implementation of the newly enacted tax laws, declaring that all remaining provisions will take effect as scheduled on January 1, 2026.

The President noted that the tax reform package includes laws that already came into force on June 26, 2025, alongside others slated for commencement in the new year, stressing that there would be no reversal or suspension of the reform timeline.

According to President Tinubu, the reforms represent a once-in-a-generation opportunity to build a fair, competitive and robust fiscal foundation for Nigeria.

He explained that the new tax laws are not to increase the tax burden on citizens but to support a comprehensive structural reset of the tax system, promote harmonization, protect human dignity and strengthen the social contract between the government and the people.

The President urged all stakeholders to rally behind the implementation process, describing the reforms as having moved firmly into the delivery phase.

President Tinubu acknowledged the ongoing public discourse surrounding alleged changes to some provisions of the recently enacted tax laws.

No substantial issues against reforms

He maintained that all issues so are not substantial enough that would justify disrupting the reform process.

President Tinubu emphasized that trust in governance is built gradually through consistent and sound decision-making, not through premature or reactive actions.

He reiterated his administration’s unwavering commitment to due process and the integrity of laws duly enacted.

The President assured Nigerians that the Presidency would continue to work closely with the National Assembly to ensure the prompt resolution of any issues that may arise during implementation.

Reaffirming his administration’s focus on the national interest, President Tinubu pledged that the Federal Government would continue to act in the overriding public interest to ensure a tax system that supports prosperity, fairness and shared responsibility across the country.